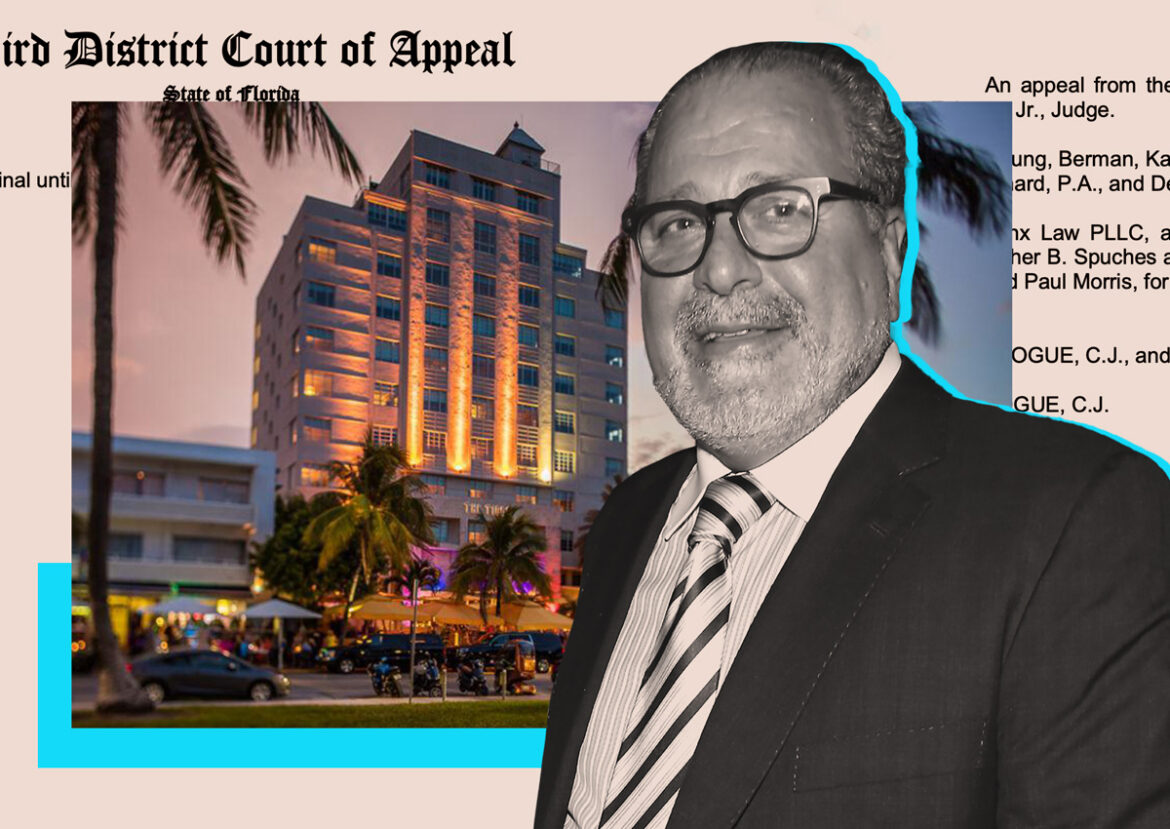

The Chetrit Group, a prominent New York-based developer, has secured a significant legal victory in its ongoing legal battle concerning the iconic Tides hotel in South Beach, Miami. The Third District Court of Appeals overturned a previous ruling that favored the lender, Safe Harbor Equity, in a dispute revolving around a $45 million loan. This development sheds light on the complexities of real estate financing and insurance practices, highlighting the contentious nature of loan agreements and property management in luxury real estate.

At the heart of the dispute lies the Tides Hotel, a prestigious 45-key property at 1220 Ocean Drive in Miami Beach. The conflict arose when Safe Harbor Equity, after acquiring the debt from Ocean Bank in early 2021, accused Chetrit of misusing $2 million in insurance funds intended for Hurricane Irma repairs and defaulting on loan obligations. The Third District Court of Appeal’s decision to reverse the summary judgment was based on conflicting testimonies regarding Ocean Bank’s awareness and approval of the insurance funds’ usage for repairs.

This reversal nullifies the previous ruling that Chetrit owed $82.1 million, including fees and interest. It highlights the intricate interpretations of loan agreements and the obligations of both lenders and borrowers within them.

The legal battle between Chetrit and Safe Harbor Equity underscores the importance of clear communication and documentation between lenders and borrowers, especially concerning the use of insurance funds for property repairs. It also exemplifies the potential for disputes arising from differing interpretations of financial agreements, impacting project timelines, refinancing opportunities, and ultimately, property value.

Moreover, this case offers insights into the strategic maneuvers employed by entities in the real estate market. Chetrit’s attempt to refinance the mortgage before Safe Harbor’s loan acquisition speaks to the challenges developers face in navigating financial hurdles, while Safe Harbor’s defense emphasizes the importance of enforcing loan documents for effective risk management.

In summary, the unfolding legal drama surrounding the Tides Hotel underscores the need for meticulous legal and financial planning within the real estate sector, highlighting the delicate balance between protecting investments and fostering development.