As Florida’s state budget negotiations heat up, property tax reform has become one of the most hotly contested issues among lawmakers—and at the center of it is Governor Ron DeSantis’s proposal to send $1,000 rebate checks to homeowners.

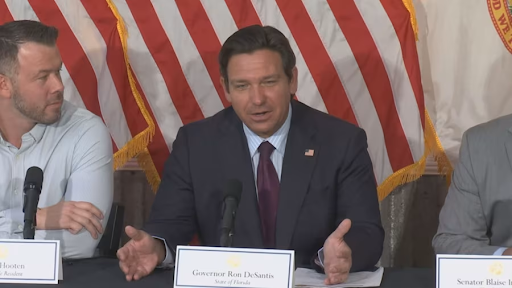

During a recent roundtable discussion in Tallahassee, Governor DeSantis doubled down on his criticism of Florida’s property tax structure, calling it a burden that punishes long-time homeowners. “This is supposed to be your private property,” he said. “But you could own your home for 50 years and still have to pay the government just to live there. When do you ever really own your home free and clear?”

The governor’s remarks highlight his broader vision to eventually eliminate property taxes for lifelong homeowners. But his plan has met resistance from legislative leaders, who argue that major tax policy changes must be more sustainable and constitutionally sound.

A Clash in the Capitol

House Speaker Daniel Perez has voiced skepticism about DeSantis’s approach, instead favoring a sweeping sales tax reduction as a more impactful solution. While not completely opposed to the idea of property tax relief, Perez noted that the governor has yet to present lawmakers with a specific, detailed proposal to act upon.

“We’re open to other options, as long as it’s a recurring tax cut,” Perez told News 6. “Yes, we support property tax relief too—but to make that happen, it requires a constitutional amendment. We don’t have the authority to eliminate property taxes without voter approval.”

Because property tax is a local issue in Florida, any significant changes at the state level would require an amendment to the state constitution. This means that at least 60% of voters would need to approve such a measure in the next general election.

The $1,000 Rebate Plan

In the short term, Governor DeSantis has proposed a one-time $1,000 rebate check for each of Florida’s 5.1 million homesteaded properties. According to a release from his office, these payments would help offset the cost of state-mandated school property taxes and offer immediate relief to homeowners. If approved, the rebates would be distributed in December 2025.

“This rebate marks a significant step toward our long-term goal of eliminating property taxes,” DeSantis’s office stated in a March announcement.

However, not everyone is on board. Speaker Perez has criticized the plan, likening it to temporary relief programs seen during the COVID-19 pandemic. “This isn’t tax reform,” he said. “It’s just a one-time giveaway. It doesn’t address structural problems or eliminate wasteful spending.”

Budget Battles Ahead

The disagreement over tax policy is just one part of a broader standoff over Florida’s budget, which must be finalized before the next fiscal year begins on July 1, 2025. On Friday, Senate President Ben Albritton announced he would not bring the House’s proposed across-the-board sales tax cut to the Senate floor, citing Governor DeSantis’s concern that such a cut would disproportionately benefit tourists and foreign visitors.

Instead, the Senate is now considering a more targeted approach to tax relief, with a focus on helping Florida’s growing families and seniors—those most directly impacted by rising property taxes and living costs.

With no final agreement yet in place, Speaker Perez has indicated that the House may extend the legislative session until June 30 to allow more time for budget negotiations.

What Comes Next?

For DeSantis’s $1,000 rebate plan to move forward, it must be approved as part of the state’s overall budget package. Meanwhile, his larger ambition to abolish property taxes for long-term homeowners will hinge on whether voters are willing to support a constitutional amendment in the next election.

While the debate continues, Florida residents are left watching closely. Will lawmakers find common ground? Or will political divisions delay the relief many homeowners are hoping for?

One thing is certain: as the July 1 deadline approaches, the question of how best to ease the financial burden on Florida’s property owners will remain front and center in the Capitol.